Digital onboarding fraud refers to the exploitation of weaknesses in online customer registration and identity verification processes.

Fraudsters manipulate digital onboarding systems to create fake accounts, steal identities, and conduct unauthorised transactions, often bypassing security measures meant to prevent fraud. This type of fraud can result in financial losses, regulatory non-compliance, and reputational damage for businesses.

As businesses across industries shift towards fully digital onboarding, fraudsters have adapted their tactics to exploit these systems. This is especially prominent in fintech, banking, eCommerce, and gaming. With the demand for seamless and fast user registration, companies prioritise convenience, often at the cost of security.

Historically, businesses have relied on OTP-based two-factor authentication (2FA) to verify users. While one-time passwords (OTPs) add an extra layer of security, they are increasingly vulnerable to interception and manipulation.

The threat landscape has evolved far beyond these methods. Fraudsters are now leveraging generative AI to create hyper-realistic, synthetic personas that traditional verification systems struggle to detect. These developments are fuelling an entirely new class of identity threats:

Deepfakes & Video Spoofing

Deepfake technology enables fraudsters to create convincing fake videos of real people, often mimicking facial expressions, voice patterns, and even mannerisms. This can be used to bypass facial recognition systems or simulate a live video identity check.

AI-Generated Fake Documents

Fraudsters are increasingly using AI to forge ultra-realistic identity documents like passports, driver’s licenses and utility bills that can pass automated document verification systems. Without robust forensic checks or cross-referencing with authoritative databases, these fakes can slip through unnoticed.

Identity Spoofing

Combining real data (such as leaked credentials from data breaches) with fabricated information, attackers construct synthetic identities that appear legitimate at face value. These are then used to create accounts, secure credit, or conduct money laundering, often without detection until much later in the fraud cycle.

As fraud techniques become more advanced, businesses can no longer rely solely on static authentication methods like OTPs and passwords. Instead, they must leverage fraud prevention APIs, mobile number intelligence, and real-time risk scoring to detect suspicious activities before onboarding is completed.

Fraudsters use multiple techniques to infiltrate digital platforms. The most common and rising forms of fraud in onboarding include:

With fraud becoming more sophisticated and scalable, businesses must shift toward real-time fraud detection, behavioural analytics, and advanced verification technologies to ensure secure and compliant digital onboarding.

Our Authenticate product is specifically designed to protect your business from these customer onboarding risks.

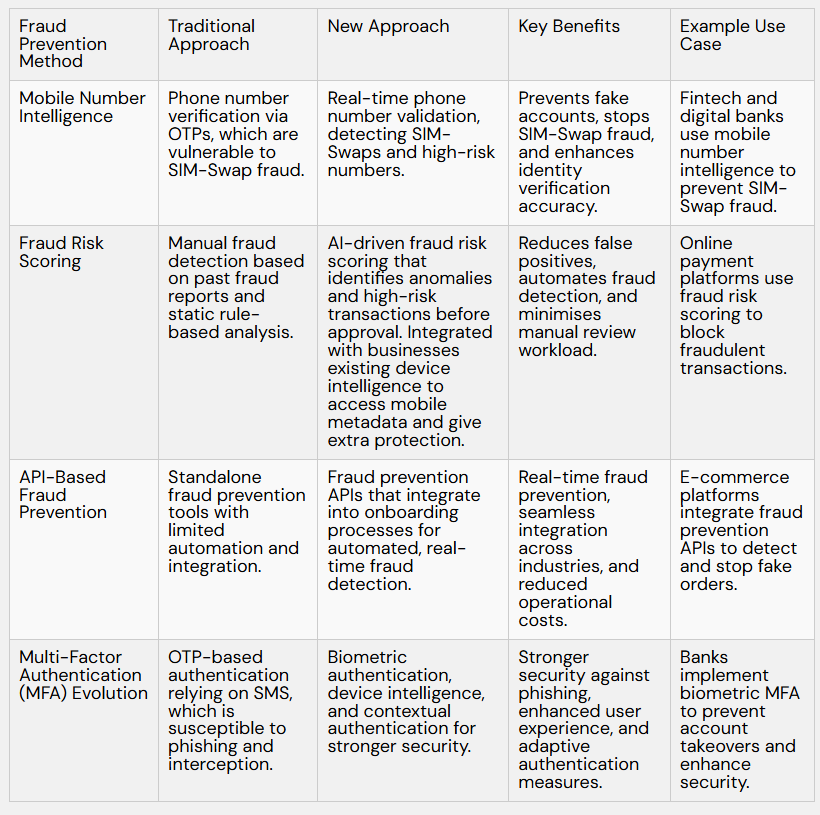

With digital onboarding fraud evolving rapidly, businesses must transition from traditional security measures to advanced fraud prevention strategies that leverage real-time intelligence and AI-driven risk assessment. Relying on outdated methods like OTP-based authentication or document verification is no longer sufficient to protect against sophisticated fraud tactics.

Instead, organisations need mobile number intelligence, fraud risk scoring, API-based fraud prevention, and next-generation multi-factor authentication (MFA) to secure digital onboarding.

Digital onboarding fraud is advancing at industrial speed, meaning complacency is no longer an option. Fraudsters are constantly exploiting gaps in traditional authentication methods. As your business scales to meet the demand for seamless, mobile-first customer experiences, your fraud prevention strategy must evolve just as rapidly.

The takeaway is clear: securing the onboarding journey at the first interaction is critical. By adopting real-time mobile number intelligence, dynamic risk scoring, and API-driven verification, you can confidently differentiate legitimate customers from bad actors before they ever gain access to your platform.

The stakes couldn’t be higher. Financial loss, regulatory penalties, and irreparable brand damage are the inevitable consequences of outdated, reactive fraud strategies. Can your business afford to wait?

Don’t let fraudsters dictate your growth. Now is the time to future-proof your onboarding process with intelligent fraud prevention prioritising security and user experience.

Book a personalised demo with our experts today and discover how our advanced fraud prevention solutions can help you detect and block suspicious activity in real-time. We have several specialist tools available, such as our Authenticate & Verify products, designed to streamline and protect your digital onboarding process.

Last updated on January 6, 2026

Onboarding is a prime target for fraudsters using fake or stolen identities. By analysing real-time and historical mobile number data, we can help businesses identify anomalies, detect potential fraud, and prevent bad actors from gaining access

Learn more about onboardingWe provide the most comprehensive device, network and mobile numbering data available

Contact us > Chat to an expert >